Top 10 New Mobile Payment Technology Trends

Day by day the expectations from technology are going to peaks and the various technological advancements are doing well in meeting these high expectations. The raise in the smartphone usage is leading to the development of lot many mobile apps. Now, there exist apps for each and everything, even for payment. This resulted in the raise in the competition for various Mobile Payments Technology trends.

Following articles presents a gist of top ten Mobile Payments trends and technologies, let us have a look into it

Table of Contents:

-

Contactless Payment

-

API- Application Programming Interfaces

-

Mobile Wallets

-

Near-Field Communication Payments (NFC)

-

Bluetooth Payment Technology

-

Assured Payment Systems

-

Mobile Device Personal Assistant

-

Rewards for Customers

-

Changed Infrastructure

-

Shift to cards from code for security

Recommended: How Much Does it Cost to Develop Taxi Booking App like OLA

-

Contactless Payment:

Contactless payment offers the user with the best security for the mobile payments. The best thing about this contactless payment is that the user need not open the wallet and make the payment which is a time consuming process.

This contactless payment is characterized by smart card, debit card, and credit cards. The usage of these cards helps in saving a lot of time and provides utmost convenience to the users. For availing this contactless payment, user just need to download the mobile wallet apps like Google pay or Apple pay.

These apps work on the radio-frequency identification (RFID) or any near field for communication. These frequencies are connected to smart chips on the devices of the cardholder. The security of the mobile payment can be ensured by the approval of the user for the transaction.

Recommended: Best Productivity Apps for Android in 2021

-

API- Application Programming Interfaces:

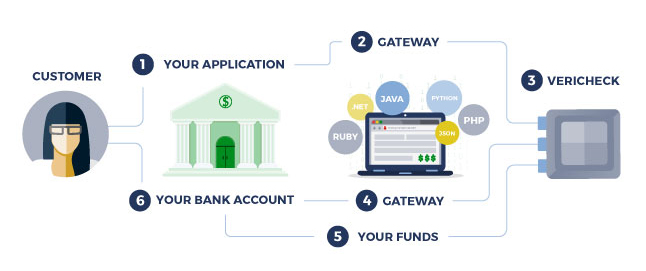

An API, Application Programming Interfaces involves making calls for the transaction procedure to complete. It get the database information from the server. This information is supplied in small packets for the safety of the user’s personal information.

This API involves the exchange of information between two different components which has got the software installed. The personal information of the user is operated within the laws of the country, but the personal is not stacked, and this offers the utmost security for the user. These API are one of the strong competitor in the financial market.

Recommended: Native vs. Cross Platform Mobile App Development: Which One Is Better?

-

Mobile Wallets:

The introduction of mobile wallets helped people in replacing their real wallet with the mobile. This mobile wallet carries all the cards details like information on credit card, debit card, and reward card in digital format. The user just need to install the mobile wallet app and enter the card information. The card information is secured by setting a key for its access. For a transaction to be done, the user need to provide this particular key. This mobile wallet will also serve for storing other information like driving license, health care details and such.

Recommended: How Much Does It Cost to Make an App?

-

Near-Field Communication Payments (NFC)

The Near-field communication payments works similarly as the contactless payment method, but stand different in the need for the presence of two devices in near vicinity. The device with a NFC chip produce a RF field. NFC serve for augmenting the system by yourself by filling out a form whose confirmation is done via SMS or by scanning the cards via an app, this will ensure the secure for the payment made.

-

Bluetooth Payment Technology

This technology makes the use of sensors present in the small batteries of it. It biggest advantage is the increased range compared to that of NFC and offers higher speed in the transaction process. This Bluetooth payment technology allows the user to make the payment even without the need of mobile phone, hence the high speed.

Recommended: Choose Top Mobile App Development Companies in India to Avail with best Results

-

Assured Payment Systems:

It is obvious that the mobile payments made need to be guaranteed by a third party like bank. This allows the transaction to follow an arrangement that takes place at a specific time which is guaranteed by the third party.

In case, consumers fail to pay, the third party i.e., bank will guarantee to pay to the business. This will make the payment more effective and efficient. For this reason, users will hold multiple cards at a time.

-

Mobile Device Personal Assistant:

As people are welcoming these non-cash payment, various technological innovations are coming into limelight at a high speed. The mobile device personal assistance helps in retrieving the data relevant to the user’s habit, interest, behavior from their online searches.

The usefulness of this data is that it provides an insight on the promotions, current deals, that can be availed using mobile phone payment.

-

Rewards for Customers

Whenever users are making payment, they are rewarded. This is revolutionizing the industry as rewards are made on transaction which are made via cards. This is attracting the users towards the use of cards for various payment transactions. The rewards include various personalized rewards that motivate the users to use it.

-

Changed Infrastructure

The conventional mode of payment cannot meet the today’s digital payment processing system. The companies which are adopting to the latest technological innovations are the order of the day. As reported by Accenture, immediate payment systems are required for bringing change in the infrastructure.

-

Shift to cards from code for security

The conventional methods of payment are getting replaced by the various technological trends like usage of cards. In the earlier days, there also exist the usage of cards, which possessed an embossed serial number, and the information of this number is stored in company’s database. The details of the transactions which are made via card are updated in the company’s database using the chip. This accounts for the safety of the account. The credentials of the payment virtual are taken care by the Blockchain, augmented reality, Internet of Things.

No doubt, the raise in the usage of smartphone has accounted for the advancements in the payment systems. All the above mentioned tech trends serve for making the payment transaction smooth and easy to the users.

If ready to go for Mobile payment related apps for your business, then SMACware can help you integrate your business with the latest AI Technologies. which is the best mobile app development company that has helped many global companies increase their business revenue. Apart from app development SMACware also expertise in Mobile Game development, video production, Photography, corporate branding, events & exhibition, digital marketing, and web development services.

[frontpage_news widget=”3117″ name=”Latest Blogs”]